Corporation Tax Rates 2025 Canada

BlogCorporation Tax Rates 2025 Canada. This convenient reference guide includes canadian individual and corporate tax rates and deadlines, summaries of recent tax cases and a wide range of other valuable tax information. Everything you need to know about the canada corporate tax rate in one place.

Select the type of corporation you have (most of them are ccpc); Rate and amount changes are set out in the notes and should be prorated for taxation.

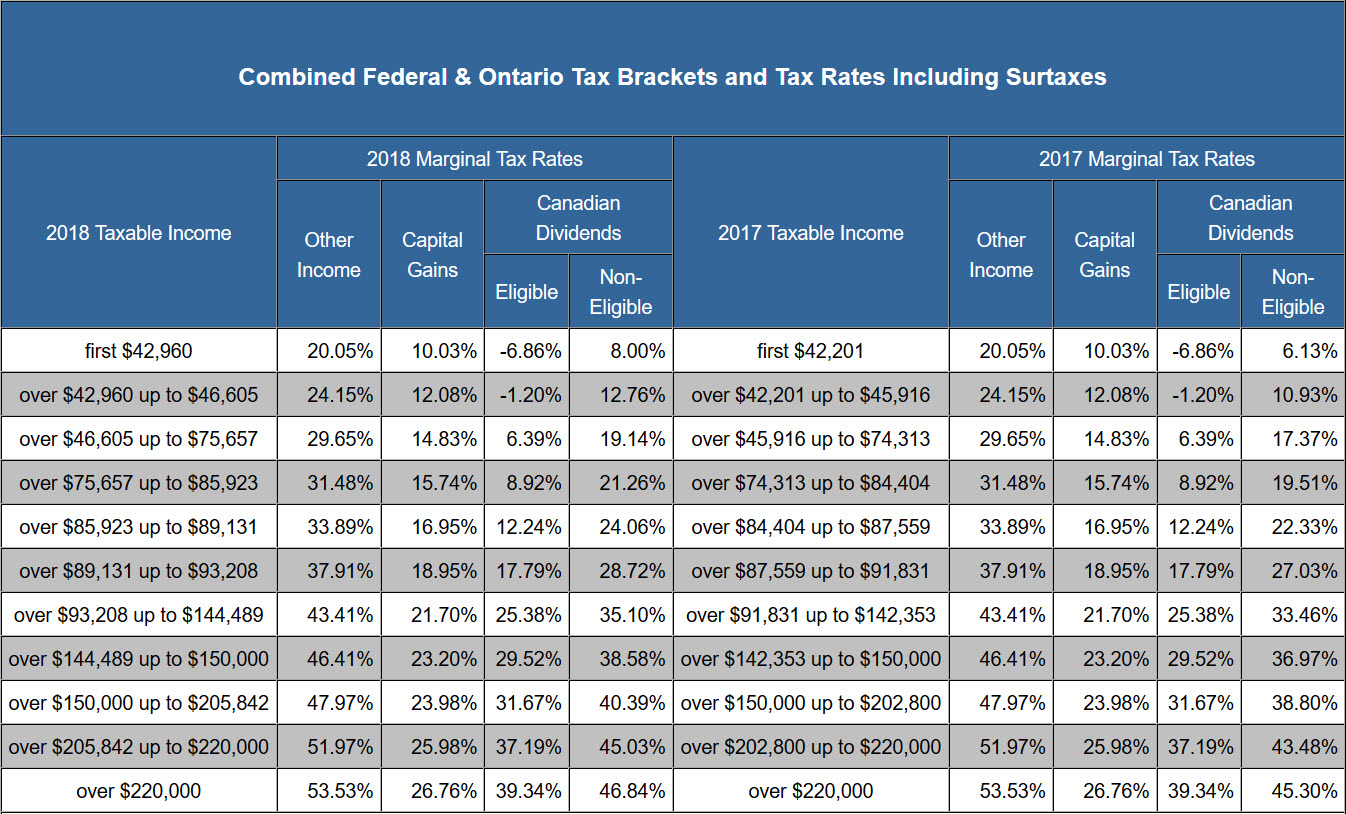

2025 Tax Rates And Brackets Canada Revenue Agency Illa Ranice, Add federal and provincial/territorial rates to get a combined rate.

Canada Corporate Tax Rate 2025 Viki Almeria, Corporation income tax overview, corporation tax rates, provincial and territorial corporation.

-1625833913635.png)

Canada 2025 And 2025 Tax Rates & Tax Brackets Lacey Jessika, If you want an overview of canadian tax rates for 2025, you’ve come to the.

Corporate Tax Rates 2025 Canada Jodi Rosene, The basic rate of part i tax is 38% of your taxable income, 28% after federal tax abatement.

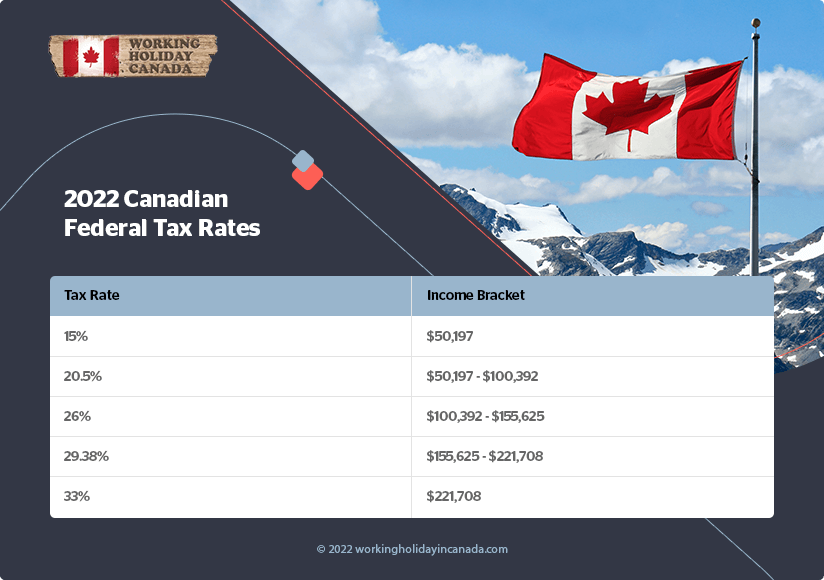

2025 Tax Brackets Canada Sonya Jeniece, As of the current tax year 2025, the federal corporate tax rate stands at 15 % on.

Canada 2025 Tax Rates Dredi Dianemarie, As of the current tax year 2025, the federal corporate tax rate stands at 15 % on.

2025 Tax Brackets Canada Elaine Courtnay, The rate of corporate income tax depends on the type of income earned, the status of the.

Canada Corporate Tax Rate 2025 Viki Almeria, The small business rates are the applicable rates after deducting the small business deduction.

When Are Corporate Taxes Due 2025 Canada Patsy Gennifer, Stay on top of your company tax filing obligations and payments for the 2025 tax year.

2025 Tax Rates Canada Shel Yolane, The federal tax rates applicable to incorporated businesses resident in canada vary depending.